| StockFetcher Forums · General Discussion · Price and Indicators | << 1 2 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #148458 - Ignore Mactheriverrat |

7/11/2019 6:34:37 AM Just was thinking how one looks at a chart and how much one could remove most of your indicators and still see the uptrend. What I've seen on other stock forums is that people tend to become paralysis analysis very easily ( me included over the years). In other words "Putting the brakes on analysis paralysis"  |

| karennma 8,057 posts msg #148467 - Ignore karennma modified |

7/11/2019 10:28:09 AM In other words "Putting the brakes on analysis paralysis" =========================================== Good for you! Most of the stocks on my watchlist have been "overbought" since April. Frankly, the only indicator worth paying attention to, IMHO, is the Guppy. Everything else is just hocus-pocus. |

| Mactheriverrat 3,178 posts msg #148471 - Ignore Mactheriverrat |

7/11/2019 4:35:32 PM There 100's if not 1000's of great trends. That's like waiting for a bear market and saying everything is oversold. Just saying! |

| Village Elder 231 posts msg #148474 - Ignore Village Elder |

7/11/2019 7:41:31 PM Not much that is clearer than this: Renko chart for ENPH No indicator needed at all. Go long when the blocks are in an uptrend, go short when they are in a downtrend. It is a shame SF does not support this chart type. |

| volvlov 32 posts msg #148475 - Ignore volvlov |

7/11/2019 10:06:35 PM I am an expert at going long into existing trends hours before they plummet :( |

| karennma 8,057 posts msg #148476 - Ignore karennma |

7/12/2019 8:49:09 AM volvlov 17 posts msg #148475 - Ignore volvlov 7/11/2019 10:06:35 PM I am an expert at going long into existing trends hours before they plummet :( ========================== LOL! Me too! That's why I quit trading. |

| karennma 8,057 posts msg #148477 - Ignore karennma |

7/12/2019 8:54:05 AM volvlov, BTW, I got out of everything in October 2018 during the "bear market" scare. But I made a major mistake, which was not getting back in when the market turned, around Xmas time. But heck! Who is watching the market during Xmas? BTW, this July market is hot! I've never seen the market so relentless during the summer. |

| graftonian 1,089 posts msg #148478 - Ignore graftonian |

7/12/2019 9:36:09 AM Be wary of getting too simple. Someone once proposed replacing aircraft instrument panels with one instrument, clearly marked with two divisions: "OK" and "BAIL OUT". |

| volvlov 32 posts msg #148491 - Ignore volvlov |

7/13/2019 12:38:51 AM @karennma Last year was my first year trading and October blew my average, but I ended of OK. Then I remained bearish into the strong bullish xmas run like an idiot. I seem to be turning it around this year. If you haven't already checked out Mac's thread on Weinstein's book, you may want to! |

| Mactheriverrat 3,178 posts msg #148494 - Ignore Mactheriverrat |

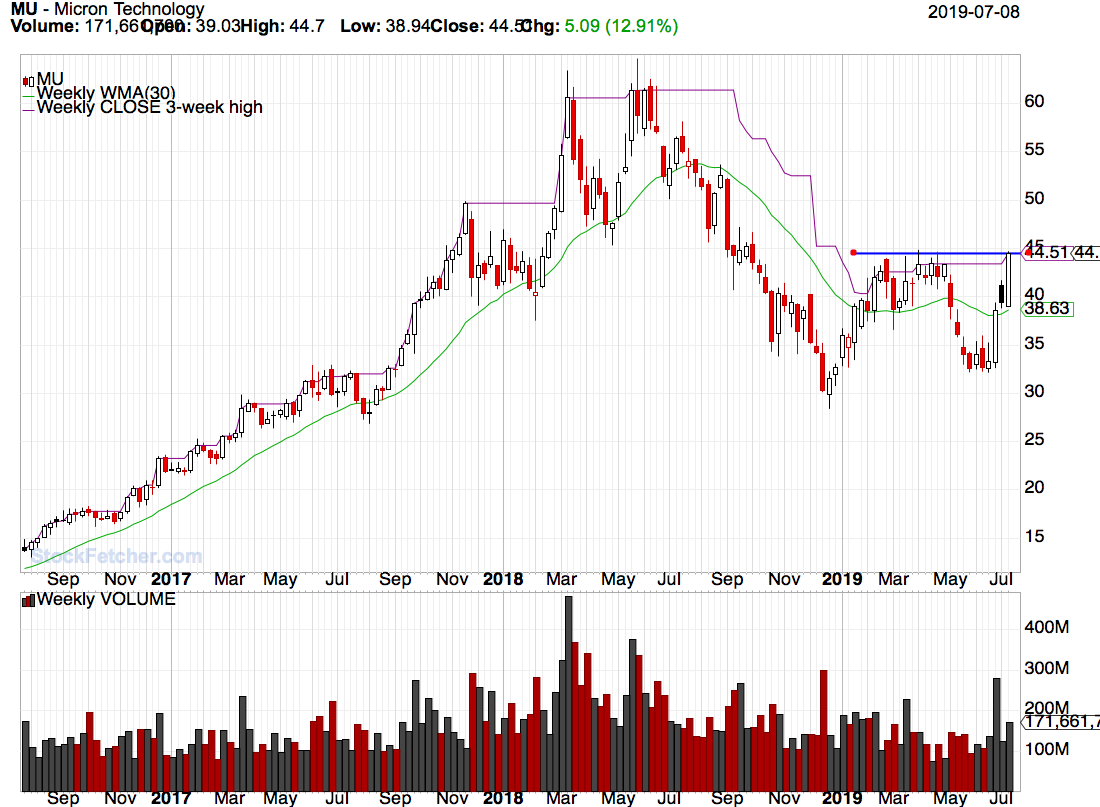

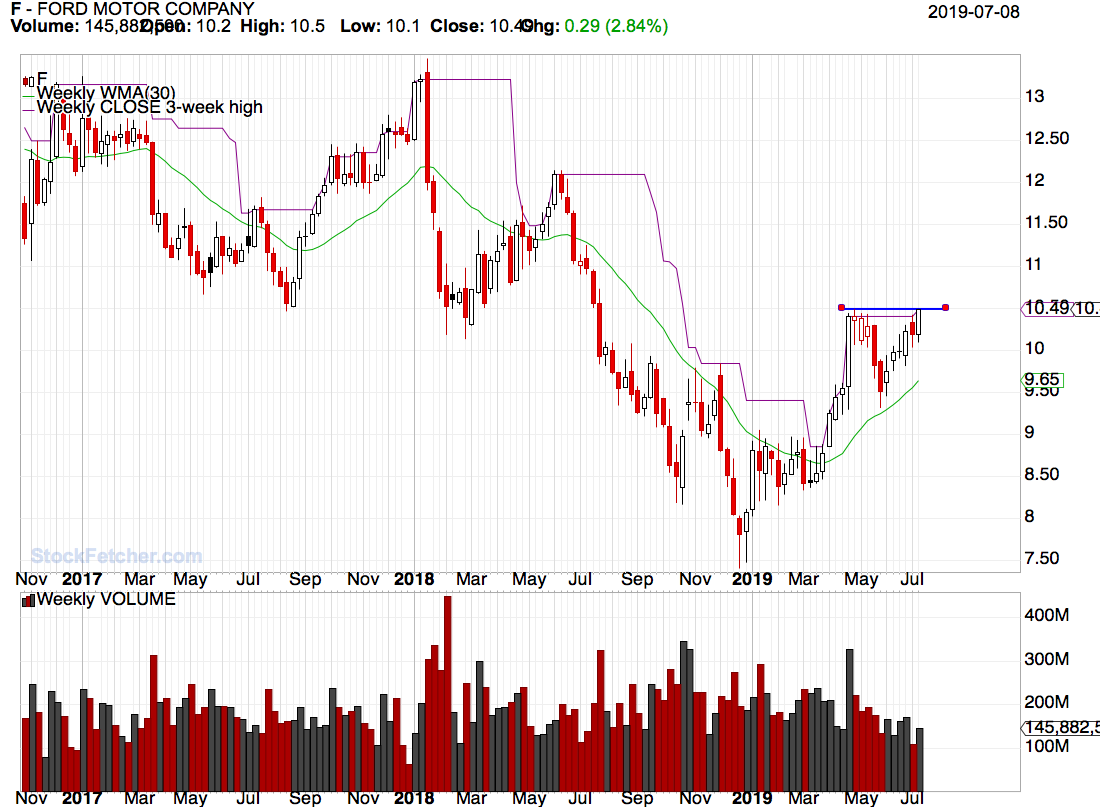

7/13/2019 7:44:48 AM Weinstein's book have gave a whole new way of looking at the way I trade. If Weinstein's book can't improve anyone's trading then no one should be trading and just let the likes of (worthless) Morgan Stanley manage your money for their fee's Primed for next week.   |

| StockFetcher Forums · General Discussion · Price and Indicators | << 1 2 >>Post Follow-up |