| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 12 13 14 15 16 ... 20 >>Post Follow-up |

| Nobody 404 posts msg #159099 - Ignore Nobody |

5/19/2022 1:49:04 PM styliten Sir I will agree 100% with you - THANK YOU that NEWR does present better opportunity. New Relic, Inc., a software-as-a-service company, provides platform for engineers to plan, build, deploy, and operate software worldwide. It offers a suite of products on its open and extensible cloud-based platform, New Relic One Platform, which enables users to collect, store, and analyze telemetry data flowing through and about their software. The company also provides prebuilt dashboards and visualizations, as well as the ability to search across data types, create customized dashboards, and build applications that can be shared and customized by other users. In addition, it offers customers with software code to add to their applications and infrastructure; open data application performance interfaces, and software development kits, as well as open source connectors and technologies for customers, partners, and third-party developers to extend its platform into their products; cloud-based architecture and big data database; and New Relic Application Performance Monitoring, Mobile, Browser, Synthetics, Infrastructure, and Insights products for analyzing data. Further, the company provides New Relic chart builder, dashboards, and programmability features that allow customers to use connected data to build visuals; New Relic Applied Intelligence to spot abnormal behavior across billions of pieces of data; and New Relic Alerts, which provides a centralized notification system. It sells its products through direct sales organizations, and online and offline sales. The company was founded in 2007 and is headquartered in San Francisco, California. |

| styliten 343 posts msg #159107 - Ignore styliten |

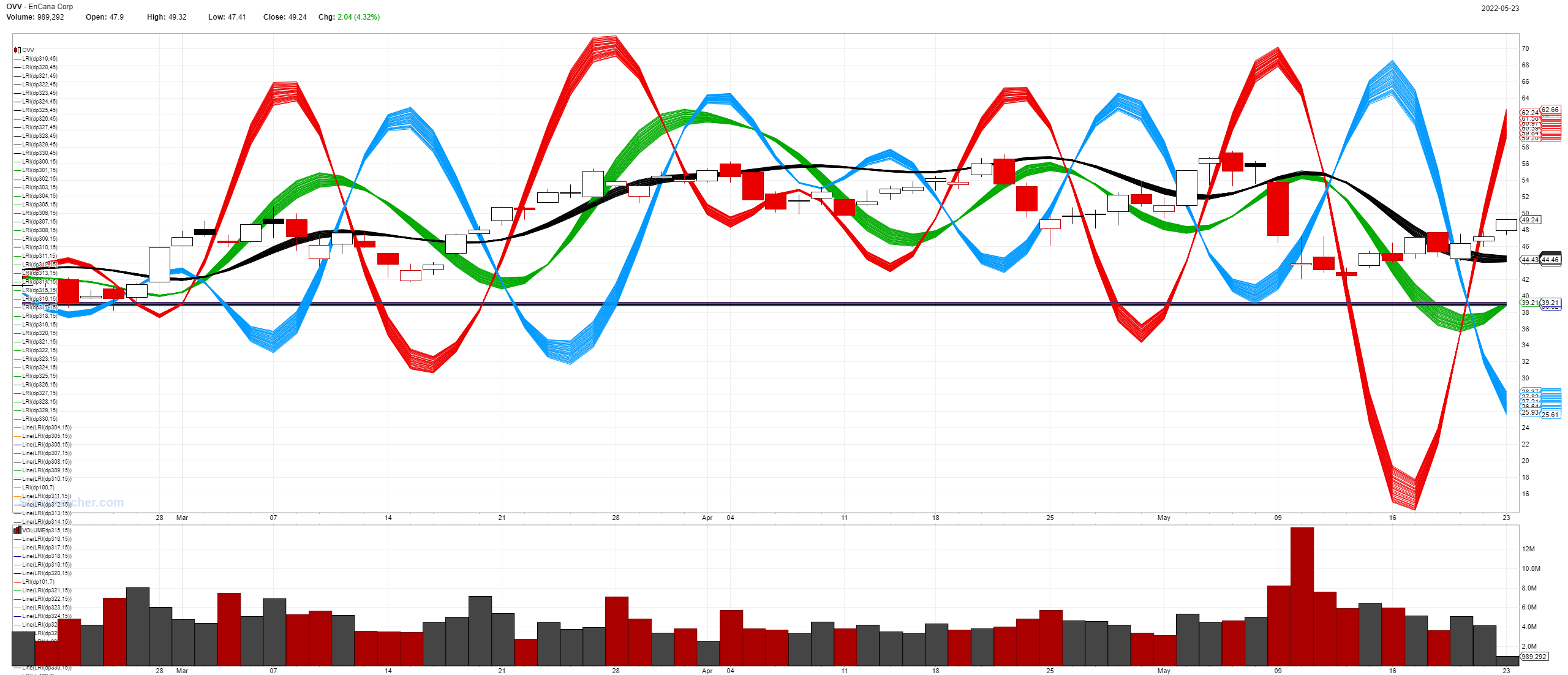

5/23/2022 12:01:52 PM @ Nobody, OVV turns out to be a pretty good catch!  |

| styliten 343 posts msg #159119 - Ignore styliten modified |

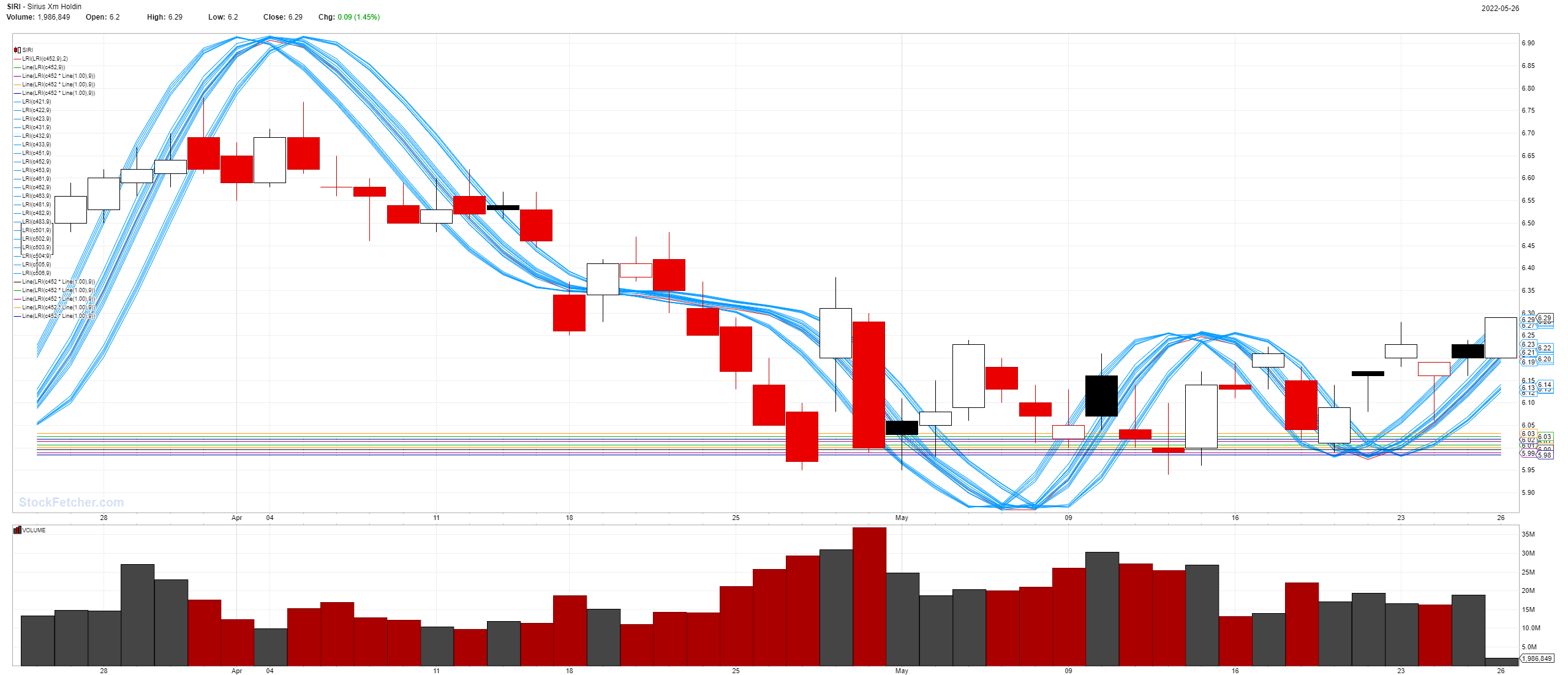

5/26/2022 10:40:22 AM @ Nobody SIRI looks very strong:  And also CHWY:  |

| Nobody 404 posts msg #159120 - Ignore Nobody |

5/26/2022 11:36:39 AM Boss styliten Thanks -- CHWY looks nice...looking at its short float% on finviz... you see that what does option chain say? Chewy, Inc., together with its subsidiaries, engages in the pure play e-commerce business in the United States. The company provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its www.chewy.com retail Website, as well as its mobile applications. It offers approximately 100,000 products from 3,000 partner brands. The company was founded in 2010 and is headquartered in Dania Beach, Florida. |

| Nobody 404 posts msg #159121 - Ignore Nobody |

5/26/2022 11:45:01 AM Disclaimer: I don't know anything CHWY - Upside quick hit and run $28-$30 Downside $24ish |

| styliten 343 posts msg #159122 - Ignore styliten modified |

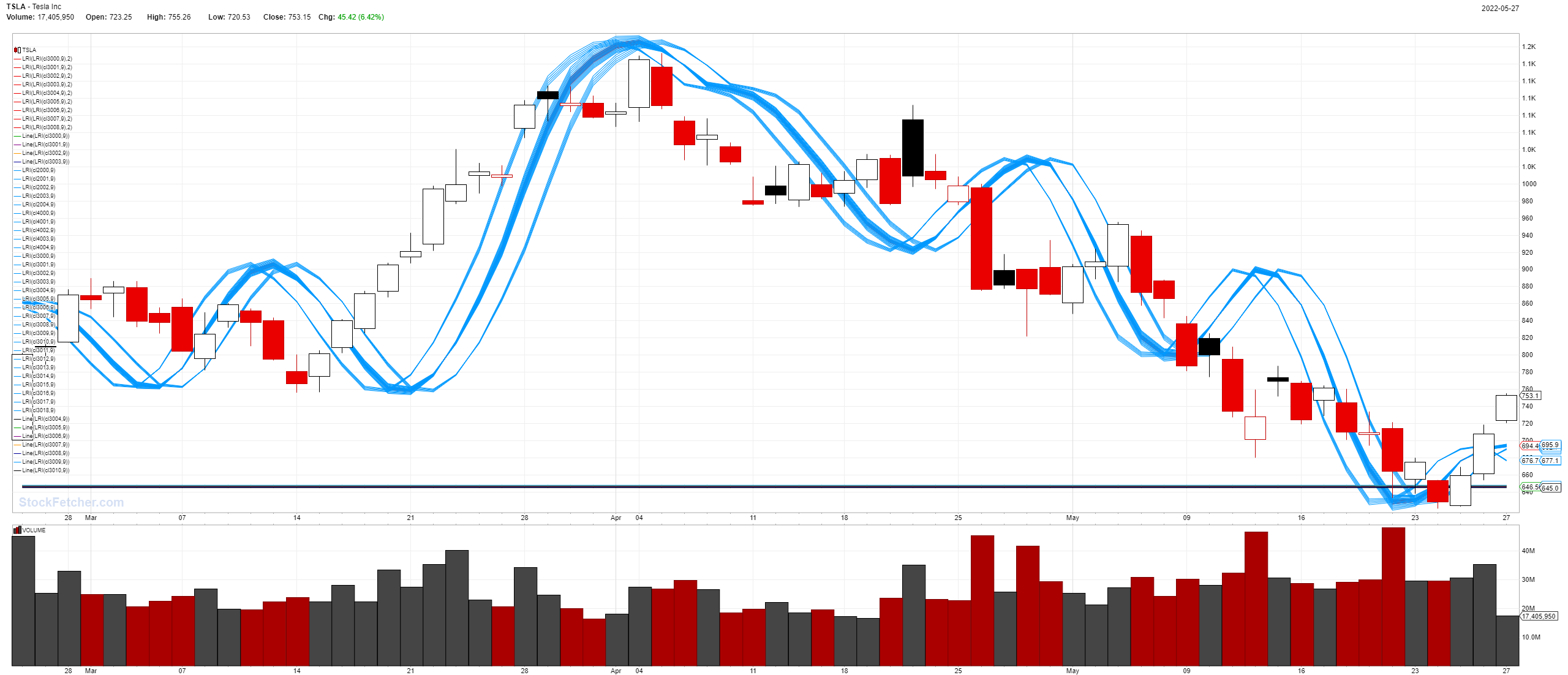

5/26/2022 11:46:01 AM @ Nobody, Quitted doing options a few years back--never had any good intraday timing mechanism for entering or exiting options! Basically 100% on the long side only. Many consumer discretionary stocks are coming back to life in the last few days: GE, GM, TSLA, GT, HOG, RIVN, WW, COST, WMT, DG, BBY, BBWI, BBY, CUK, NCLH, RCL, CCL, MAR, HLT, CSX, BYND, GLW, EBAY, INTC, QCOM, SIRI, AAL, UAL, DAL, SAVE, AZUL, LUV, ULCC, FDX, etc., etc. and MANY banking financial services stocks as well, not to mention oil stocks! |

| Nobody 404 posts msg #159124 - Ignore Nobody modified |

5/26/2022 4:14:41 PM Hi styliten Never played options in my life. I do look at them as a form of indication trying to mix-up all fundamentals and technicals to make decisions. My job doesn't allow me to day trade so mainly med-long term stuff. Just a woookie here :) |

| styliten 343 posts msg #159127 - Ignore styliten modified |

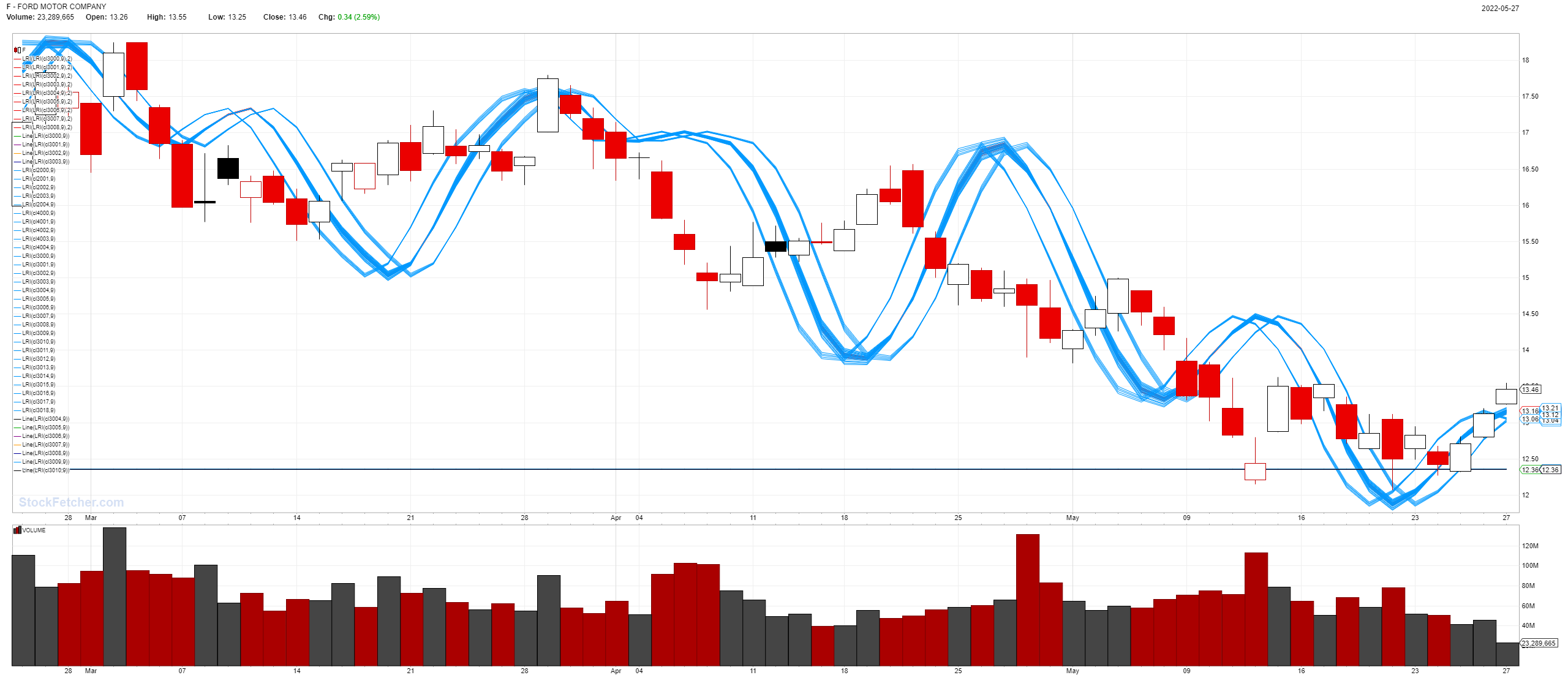

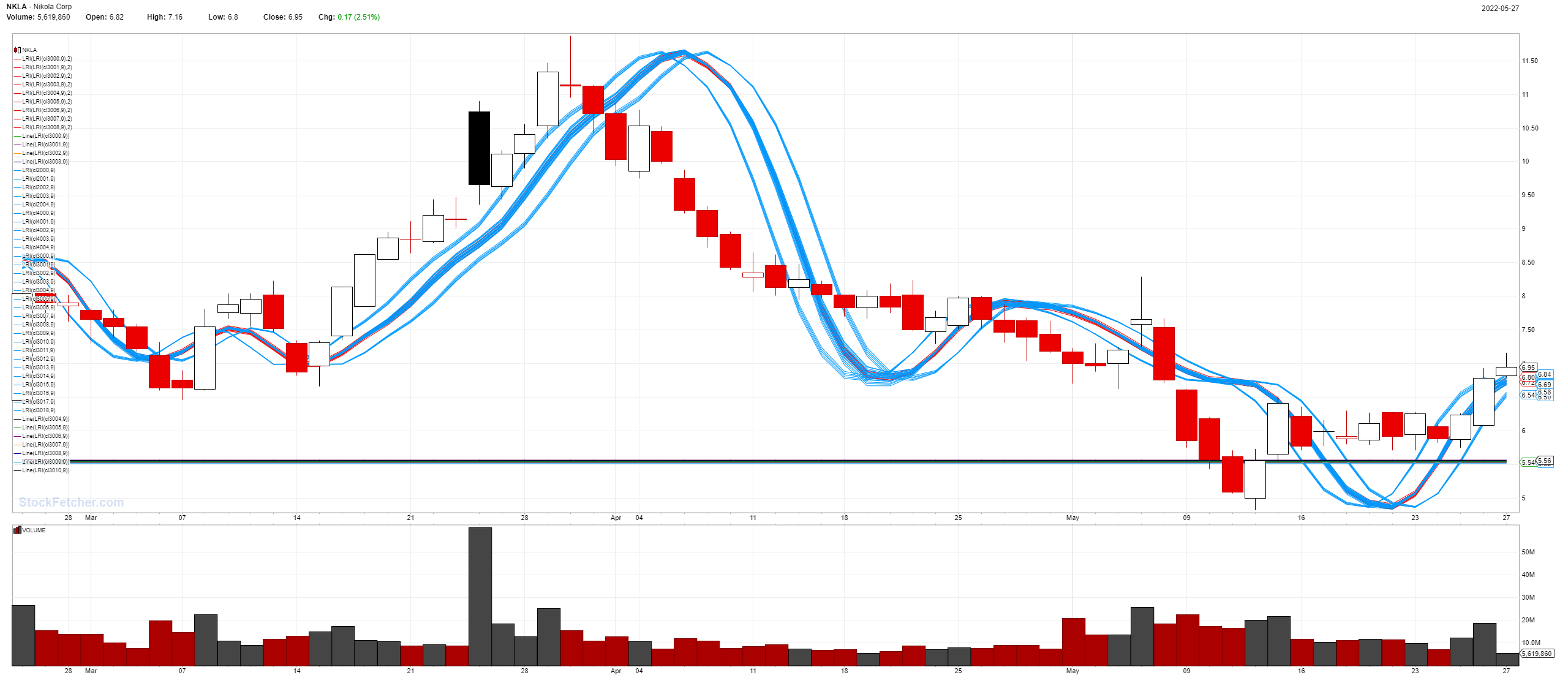

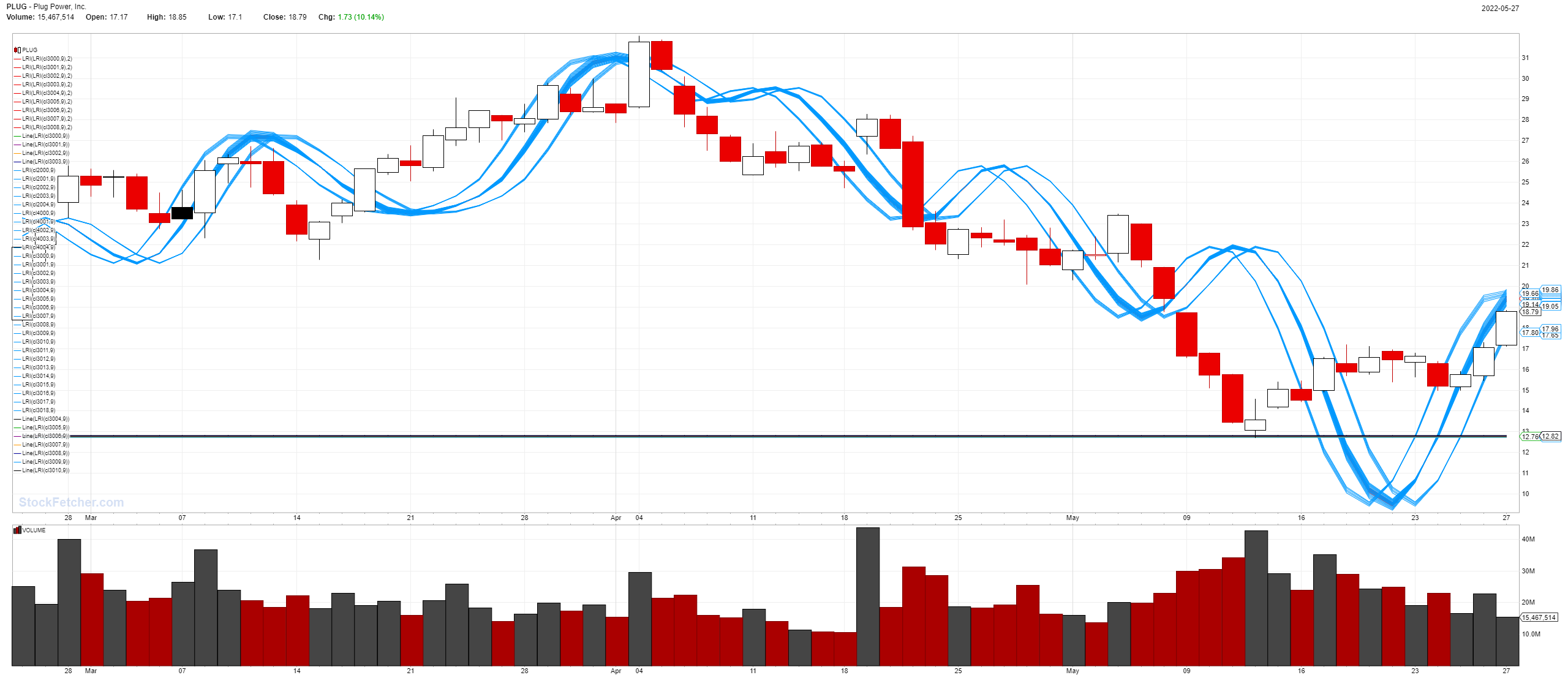

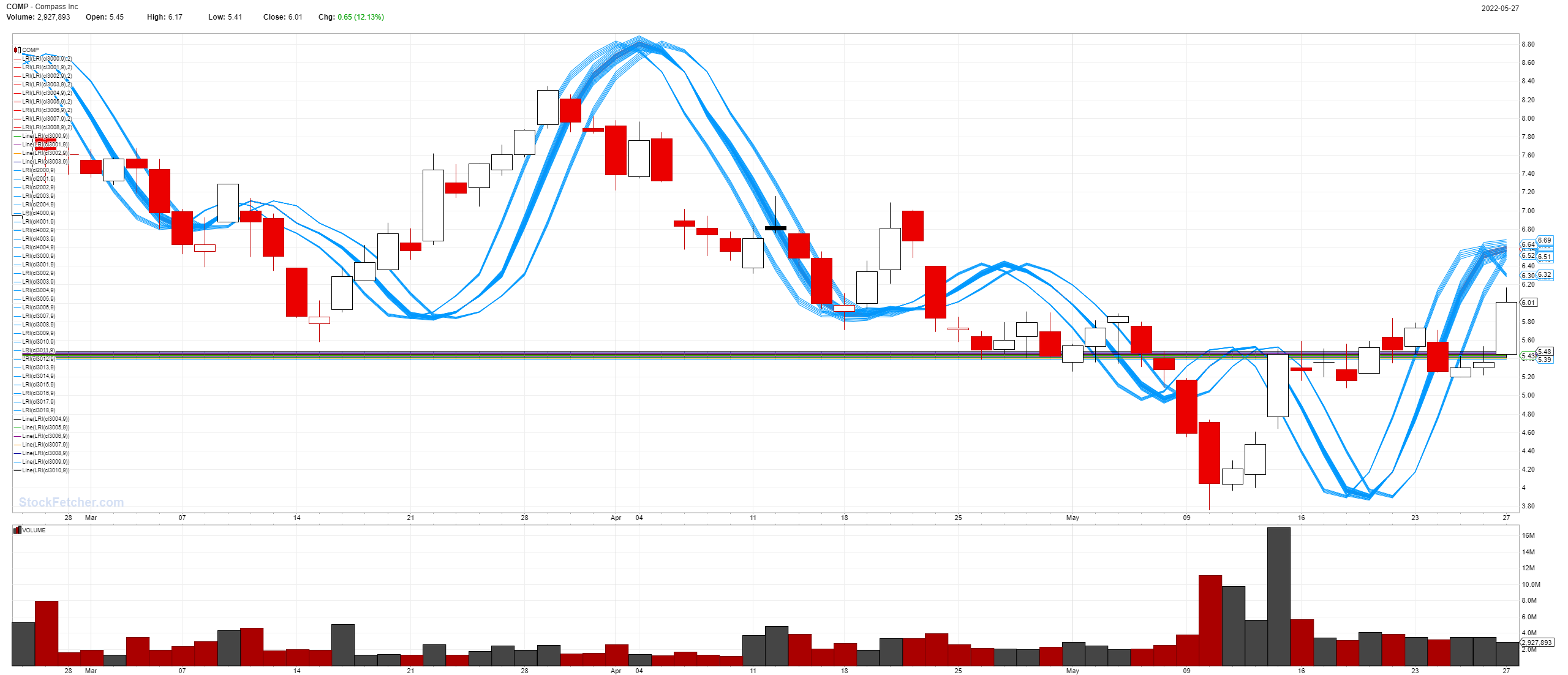

5/27/2022 12:26:29 PM F:  NKLA:  PLUG:  BYND:  TSLA:  COMP:  |

| Nobody 404 posts msg #159140 - Ignore Nobody |

5/30/2022 4:37:51 PM styliten Trust you enjoying long weekend. |

| styliten 343 posts msg #159143 - Ignore styliten |

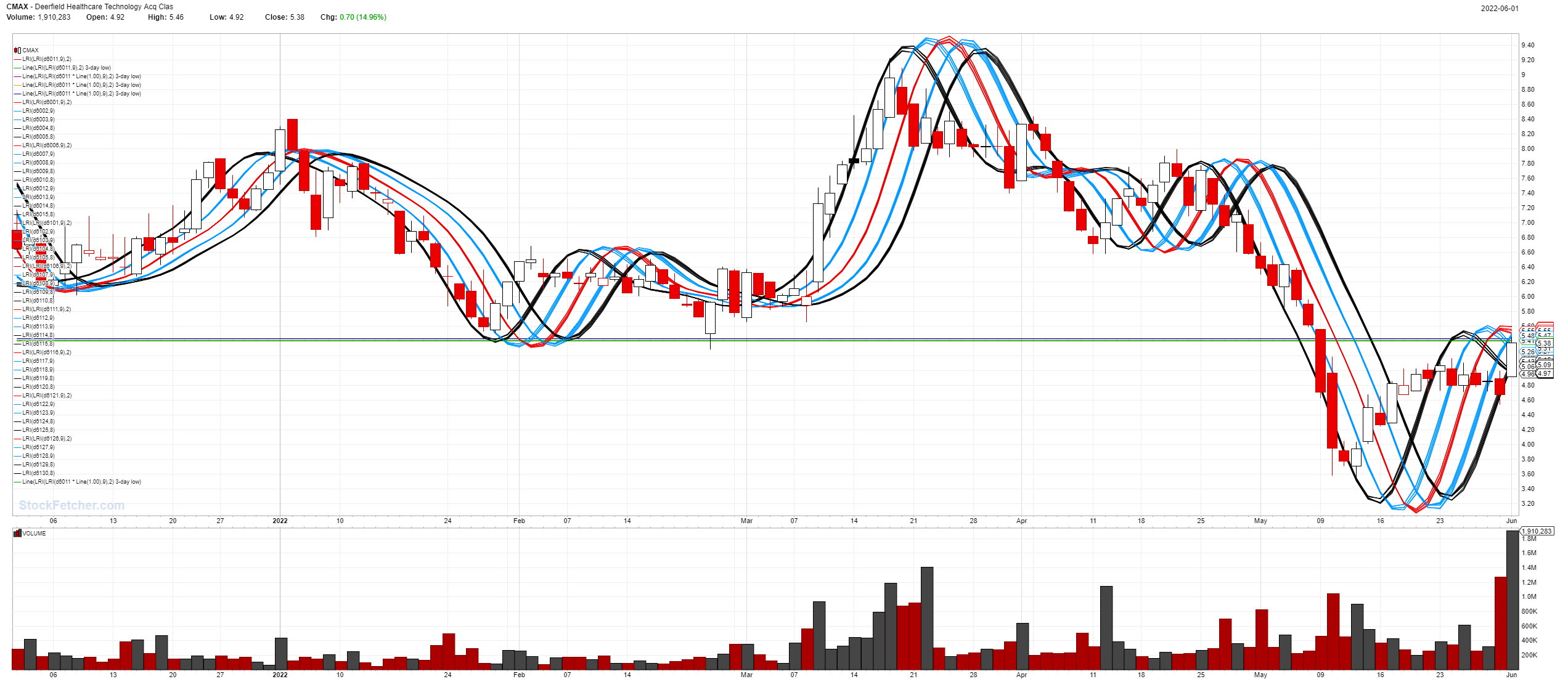

6/1/2022 2:18:33 PM @ Nobody, Which would you pick today, from the following 4? 1. AVYA:  2. GTYH:  3. VAXX:  4. CMAX:  |

| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 12 13 14 15 16 ... 20 >>Post Follow-up |